Lately it seems that the word on everyone’s lips is “blockchain.” What started as the obscure engine for cryptocurrencies like Bitcoin is now being adopted by some of the world’s largest corporations and institutions. In the logistics world, even the technologically averse are beginning to learn what blockchain is and how it stands to impact global supply chains. Depending on who you ask, blockchain is either an empty buzzword surrounded by a lot of overblown hype, or an innovation on par with the internet itself. Which it turns out to be will depend on the willingness of all parties to adopt blockchain technology, and whose version of blockchain reaches critical mass first.

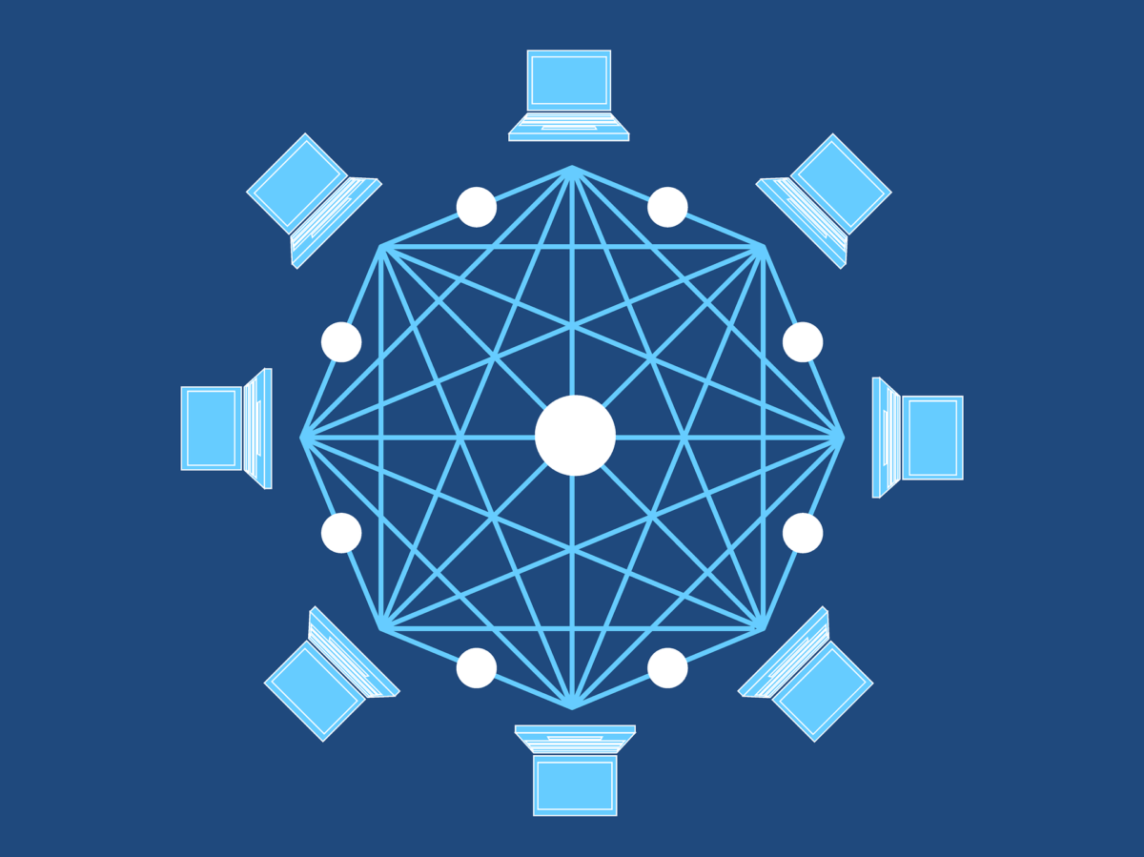

It’s easy to get confused by the technical language surrounding blockchain–“miners” “tokens” and “hard forks”–but the underlying principal is more intuitive than it first appears. At bottom, blockchain is nothing more than a protocol for processing and recording transactions in a way that is decentralized and very difficult to tamper with, making it several orders of magnitude more secure than traditional transactions. The core of what blockchain does is create trust between parties. This innovation was crucial for Bitcoin, which sought to create a secure financial ecosystem away from the central authority of a bank: thus, all Bitcoin transactions are recorded in a public ledger, in which data is encoded but still visible.

Since its inception, however, the true potential of blockchain has expanded in ways that go far beyond financial transactions. Reuters gives the example of property ownership in countries where deed records are often shoddily maintained or at risk of corruption. A blockchain database creates an immutable record of land ownership that allows people to know with confidence that they own their lands and homes, thus allowing them to take out loans on their property, and resist criminal or governmental intimidation. This simple application could be an enormously stabilizing and wealth-creating force in emerging economies.

In the United States, major companies are eager for the chance to use blockchain to improve food safety. A consortium of retailers and producers, including Nestlé, Tyson Foods, Unilever, Kroger, and Walmart, have engaged IBM’s blockchain platform to trace food shipments, in an effort to stop the spread of foodborne illnesses by quickly tracing products to their sources. Announcing the project, Kroger’s vice president of Corporate Food Technology and Regulatory Compliance said, “Food safety is a universal priority for food retailers and companies. It’s not a competitive advantage; it benefits our customers to have greater transparency and traceability in the supply chain.”

In the worlds of freight brokerage and supply chain management, many are hopeful that blockchain will be the “magic bullet” we’ve been waiting for: a standardized, automated tracking system that will provide huge leaps in efficiency and transparency. Maersk, the world’s largest shipping line, is betting on that being the case, and has partnered with IBM to create a blockchain-based trading platform that will track its millions of shipping containers throughout the world. The platform, which is set to debut later this year, will create a single, unified record of goods from farm or factory to retail shelves.

Currently, the huge amount of paperwork for any shipping container, and the number of hands it passes through, has led to a system that is both inexcusably inefficient and rife with fraud and theft. In theory, a fully functional blockchain ledger would mean that no more containers of perishable goods would rot on docks because of a single misplaced document. It would mean that no one along the supply chain could retroactively edit information to disguise its origins or cover up missing inventory. The potential savings with such a platform could be in the billions of dollars. Some overexcited observers from the tech world have speculated that freight forwarders and brokers would be rendered obsolete by such a system, but most in the logistics world would welcome the opportunity to speed shipments, simplify customs procedures, and focus their energies elsewhere.

Of course, there are certain parties for whom the supply chain’s opacity is (to borrow a phrase from tech) “a feature, not a bug.” Maersk’s Chief Financial Officer, Vincent Clerc, acknowledged this, saying, “There is a strong push from the end-customer to see this change. We may meet initial resistance from one part of the ecosystem, [but] the success of the platform depends on acceptance of all participants.” So, while attempting to enforce end-to-end adoption will no doubt be a herculean challenge, shippers, brokers, and retailers have the combined clout to push for it, provided they recognize the chance for huge financial savings.

For shippers wondering what to do about blockchain, the answer, for now, is to keep an eye on the major players. IBM isn’t the only company developing Blockchain-based platforms; Microsoft has its own blockchain division with high-profile clients, and there are blockchain purists who object to the technology, which was originally conceived as a radically public tool, being controlled by a few major corporations. Blockchain is still in its infancy, the point for any technology at which its applications seem boundless and its limitations have not yet been discovered. At the very least, though, it’s time for everyone along the supply chain to acknowledge that blockchain isn’t just a passing fad, and start thinking creatively about how to harness its potential.